2025 Crypto Mining Machine Reviews: Power, Efficiency, and Profitability

As we step into 2025, the world of cryptocurrency mining pulses with unprecedented energy, driven by cutting-edge machines that promise not just power, but a symphony of efficiency and profitability. Gone are the days of rudimentary setups; today, mining machines stand as titans, harnessing the raw might of technology to unearth digital gold. From Bitcoin’s unyielding blockchain to Ethereum’s smart contract revolutions, these devices are the unsung heroes fueling the crypto ecosystem. Imagine vast mining farms humming in harmony, where every watt of electricity translates into potential fortune, and hosting services offer a seamless gateway for enthusiasts worldwide.

At the heart of this transformation lies the mining machine itself—a marvel of engineering that balances brute force with elegant design. Take, for instance, the latest models optimized for Bitcoin mining. These rigs, with their ASIC chips, deliver hashing powers exceeding 200 terahashes per second, turning the complex puzzles of the Bitcoin network into solvable equations at lightning speed. Yet, it’s not just about raw power; efficiency reigns supreme. In 2025, machines boasting energy efficiencies of under 20 joules per terahash are becoming the norm, slashing operational costs and making mining accessible even in regions with fluctuating electricity prices. This shift is pivotal for profitability, as miners can now project returns with greater accuracy, factoring in variables like network difficulty and block rewards.

Delving deeper, let’s explore how these advancements impact other cryptocurrencies, such as Ethereum and Dogecoin. Ethereum’s transition to proof-of-stake has reshaped the landscape, yet dedicated ETH mining rigs persist for those clinging to the old ways or exploring hybrid models. These machines, often GPU-based, offer versatility, allowing miners to switch between ETH and other altcoins with minimal reconfiguration. Meanwhile, Dogecoin’s lighthearted community thrives on accessible mining, where entry-level rigs provide a fun, low-barrier entry point. The profitability here hinges on community-driven pumps and dumps, creating a volatile yet exhilarating market that keeps miners on their toes.

Now, picture the role of mining farms in this grand tapestry—vast warehouses filled with synchronized rigs, optimized for maximum output. These facilities, often run by companies specializing in hosting services, handle the heavy lifting so individual miners can focus on strategy rather than maintenance. By 2025, top-tier farms incorporate AI-driven cooling systems and renewable energy sources, dramatically reducing environmental footprints while boosting uptime. For Bitcoin enthusiasts, this means consistent hashrates that directly correlate with rewards, potentially yielding annual returns upwards of 50% for well-placed investments.

But what about the miners themselves? These dedicated individuals or entities, armed with state-of-the-art equipment, navigate a world of exchanges and market fluctuations. In 2025, tools like automated trading bots integrate seamlessly with mining operations, allowing profits from mined coins to be swiftly converted or staked. For Ethereum miners, this could involve bridging to decentralized finance platforms, where yields compound exponentially. The burst of innovation doesn’t stop there; mining rigs are evolving into modular beasts, with interchangeable components that adapt to emerging coins like Solana or Cardano, ensuring longevity and adaptability in an ever-shifting crypto sea.

The profitability equation, however, is a delicate balance. Factors like electricity costs, machine depreciation, and network competition can make or break a setup. A top-of-the-line miner might cost upwards of $10,000, but with efficient models, payback periods shrink to under six months for Bitcoin. Hosting services amplify this by offering tiered plans—basic for casual users, premium for high-volume operations—that include remote monitoring and security. This ecosystem fosters a rhythmic dance between risk and reward, where a sudden surge in Dogecoin’s price could turn a modest rig into a goldmine overnight.

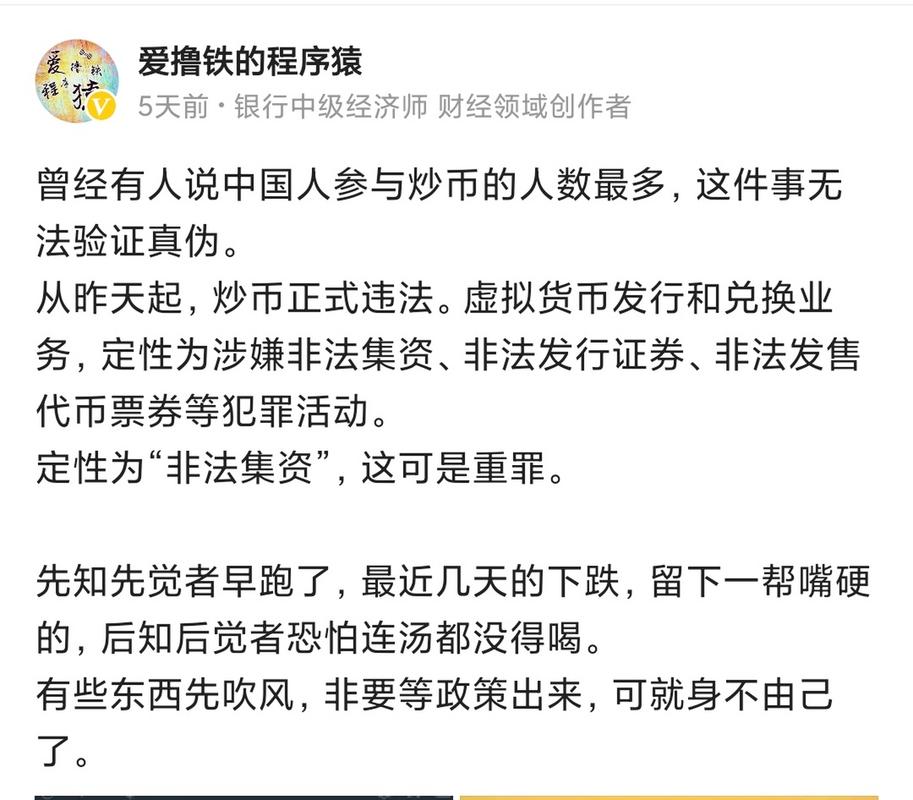

Unpredictability adds spice to the mix; one day, a regulatory shift might dim the lights on certain coins, while the next brings a technological breakthrough. Exchanges play a crucial role here, providing liquidity and price discovery that influence mining decisions. In 2025, integrated platforms allow miners to sell directly from their rigs, cutting out middlemen and enhancing profit margins. For ETH and BTC alike, this interconnectedness creates a vibrant, pulsating network where efficiency isn’t just a feature—it’s the lifeline.

In conclusion, the 2025 crypto mining machine landscape is a testament to human ingenuity, blending power, efficiency, and profitability into a compelling narrative. Whether you’re drawn to the steadfast allure of Bitcoin, the innovative spirit of Ethereum, or the whimsical charm of Dogecoin, the right machine and hosting strategy can unlock doors to financial freedom. As the industry evolves, so too will the tools at our disposal, promising a future where mining isn’t just about digging for coins—it’s about shaping the digital economy with every calculated hash.

A deep dive into 2025’s crypto mining rigs. Efficiency reigns supreme; profitability, a complex dance. Power consumption, a key differentiator. Next-gen tech battles rising difficulty. Are they worth the investment?