Expert Insights: What Mining Hardware Will Dominate in 2025?

As the cryptocurrency landscape continues to evolve at a breakneck pace, one question looms large for investors, miners, and enthusiasts alike: What mining hardware will rise to dominance by 2025? With Bitcoin still reigning as the king of digital currencies and Ethereum pushing boundaries through its upgrades, the hardware powering these networks must adapt or risk obsolescence. Companies specializing in selling and hosting mining machines, like ours, are at the forefront of this revolution, offering not just equipment but comprehensive solutions for efficient crypto mining. Imagine a world where energy-efficient rigs not only mine Bitcoin but also support the quirky rise of Dogecoin or the smart contract capabilities of Ethereum—all while minimizing environmental impact.

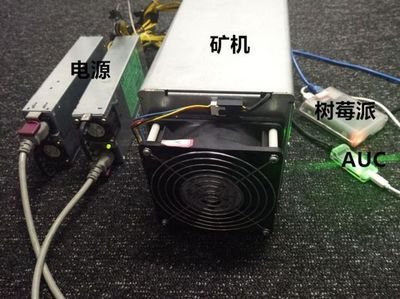

The journey of mining hardware has been nothing short of dramatic. From the early days of CPU mining to the GPU wars and now the ASIC dominance, innovation has been relentless. Bitcoin, or BTC, demands specialized Application-Specific Integrated Circuit (ASIC) miners that can handle its proof-of-work consensus with brute force efficiency. These machines, often sold by experts in the field, are engineered for one purpose: to crunch hashes faster than competitors. Yet, as we gaze toward 2025, whispers of quantum-resistant algorithms and sustainable energy sources suggest a shift. Will next-generation ASICs, perhaps integrated with AI optimizations, take the throne? Or could versatile GPU-based mining rigs make a comeback, especially for altcoins like Ethereum, which is transitioning to proof-of-stake but still relies on hardware for other networks?

Enter the realm of mining farms and hosted solutions, where scalability meets convenience. For those diving into Dogecoin (DOG) mining, which thrives on community-driven fun and lower barriers to entry, affordable yet efficient miners could be game-changers. Unlike the heavyweight BTC operations, DOG’s lighter proof-of-work might favor multi-purpose rigs that can switch between coins seamlessly. Our company’s hosting services shine here, allowing users to rent space in state-of-the-art mining farms without the hassle of setup or maintenance. Picture vast warehouses humming with thousands of miners, their LEDs blinking like stars in a digital galaxy, all optimized for currencies like ETH and DOG. By 2025, we predict a surge in hybrid models—machines that not only mine but also participate in decentralized exchanges, blending hardware prowess with DeFi opportunities.

Burst onto the scene are advancements in cooling technology and energy efficiency, crucial for sustaining profitability amid fluctuating crypto prices. Ethereum’s shift to proof-of-stake with its Ethereum 2.0 upgrade might reduce the need for traditional mining rigs, but don’t count them out yet; side chains and layer-2 solutions could keep GPU demand alive. Miners, those intrepid individuals or entities running the show, will seek hardware that adapts to regulatory changes and market volatility. A mining rig today might include not just processors but integrated systems for remote monitoring, ensuring that even in a hosted setup, users retain control. This unpredictability adds a thrilling layer—will 2025 see a dominance of eco-friendly rigs powered by renewable energy, or perhaps a dark horse like specialized hardware for emerging coins?

Delving deeper, let’s consider the competition. Bitcoin’s network, with its unyielding demand for computational power, will likely favor ASIC miners from top manufacturers, evolving to handle larger block sizes or enhanced security protocols. Meanwhile, for Ethereum and its ecosystem, the focus might pivot to more flexible hardware that supports staking wallets or NFT minting. Dogecoin, ever the underdog, could spark innovation in budget-friendly mining solutions, drawing in newcomers and boosting exchange activity. Exchanges themselves play a pivotal role, as they connect mined coins to global markets, influencing hardware choices based on profitability metrics. Our expertise in selling and hosting ensures clients are equipped for these shifts, offering tailored rigs that maximize returns across BTC, ETH, and DOG.

Yet, the future isn’t without challenges. Regulatory hurdles, such as those in major mining hubs like China or the U.S., could reshape the landscape, pushing towards more decentralized or mobile mining options. Imagine a 2025 where mining rigs are as portable as laptops, hosted in data centers worldwide for optimal uptime. This diversity in approach—balancing centralized farms with personal setups—creates a rhythmic dance of technology and strategy. For those invested in the crypto world, staying ahead means embracing hardware that’s not only powerful but also adaptable, much like the currencies they support.

In conclusion, by 2025, the mining hardware that dominates will be a blend of efficiency, versatility, and sustainability. Bitcoin may still anchor the market with its ASIC behemoths, but Ethereum’s evolution and Dogecoin’s charm will diversify the field. Whether you’re buying a miner, opting for hosting services, or exploring exchanges for trading, the key lies in strategic choices. As experts in this domain, we urge you to prepare for a future where hardware isn’t just about power—it’s about foresight, innovation, and the endless possibilities of the crypto universe.

Forget ASICs? Quantum mining whispers are growing louder. 2025’s top rig might not be silicon-based at all, experts hint, but something far stranger. Prepare for disruption.